huntsville al sales tax calculator

Method to calculate West Huntsville sales tax in 2021. Huntsville in Alabama has a tax rate of 9 for 2022 this includes the Alabama Sales Tax Rate of 4 and Local Sales Tax Rates in Huntsville totaling 5.

What Is The Sales Tax Rate In Huntsville Al Dtaxc Cuitan Dokter

Alabama AL Sales Tax Rates by City H The state sales tax rate in Alabama is 4000.

. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Real property tax on median home. While Alabama law allows municipalities to collect a local option sales tax of up to 3 Huntsville does not currently collect a local sales tax.

1-334-844-4706 Toll Free. Sales Tax State Local Sales Tax on Food. For tax rates in other cities see Alabama.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Overview of Alabama Taxes. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. The December 2020 total local sales tax rate was also 9000. One of a suite of free online calculators provided by the team at iCalculator.

Within Huntsville there are around 24 zip codes with the most populous zip code being 35810. The Huntsville Alabama sales tax is 900 consisting of 400 Alabama state sales tax and 500 Huntsville local sales taxesThe local sales tax consists of a 050 county sales tax and a 450 city sales tax. With local taxes the total sales tax rate is between 5000 and 11500.

This includes the rates on the state county city and special levels. The Huntsville Sales Tax is collected by the merchant on all qualifying sales made within Huntsville. It is unlawful for the seller to keep any portion of sales tax collected from customers.

Sales Tax State Local Sales Tax on Food. See how we can help improve your knowledge of Math. Alabama has income taxes that range from 2 up to 5 slightly below the national average.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. What is the sales tax rate in Huntsville Alabama. Did South Dakota v.

The County sales tax rate is. Interactive Tax Map Unlimited Use. Whether youre a Huntsville Havoc or a Birmingham Barons fan youre going to get taxes taken out of.

Huntsville is located within Madison County Alabama. SmartAssets Alabama paycheck calculator shows your hourly and salary income after federal state and local taxes. The current total local sales tax rate in Huntsville AL is 9000.

Alabama has a 4 statewide sales tax rate but also has 350 local tax jurisdictions including. You can print a 9 sales tax table here. City of Huntsville Alabama Best Place to Live in US.

1918 North Memorial Parkway Huntsville AL 35801 256 532-3498 256 532-3760. Huntsville is located within Schuyler County Illinois. The sales tax jurisdiction name is Madison which may refer to a local government division.

You can find more tax rates and allowances for Huntsville and Alabama in the 2022 Alabama Tax Tables. Huntsville collects a 5 local sales tax the maximum local sales tax. Alabama has recent rate changes Thu Jul 01 2021.

Per 40-2A-15 h taxpayers with complaints related to the auditing and collection activities of a private firm auditing or collecting on behalf of a self-administered county or municipality may call ALTIST Certified Auditors Complaint Hotline. The Sales tax rates may differ depending on the type of purchase. The 9 sales tax rate in Huntsville consists of 4 Alabama state sales tax 05 Madison County sales tax and 45 Huntsville tax.

Select the Alabama city from the list of cities starting with H below to see its current sales tax rate. In Alabama the sales tax rate is 4 the sales tax rates in cities may differ to upto 5. This is the total of state county and city sales tax rates.

The Huntsville Alabama sales tax is 900 consisting of 400 Alabama state sales tax and 500 Huntsville local sales taxesThe local sales tax consists of a 050 county sales tax and a 450 city sales tax. THE SALES TAX DEPARTMENT OVERSEES THE FOLLOWING MADISON COUNTY TAXES ON BEHALF OF THE MADISON COUNTY COMMISSION. Monday - Friday 800 AM - 430 PM.

The Huntsville Alabama sales tax is 400 the same as the Alabama state sales tax. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Method to calculate Huntsville sales tax in 2021.

The average cumulative sales tax rate in Huntsville Illinois is 725. Sales Tax Calculator Sales Tax Table. The Huntsville sales tax rate is.

A full list of locations can be found below. The minimum combined 2022 sales tax rate for Huntsville Alabama is. For tax information.

The Huntsville Alabama Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Huntsville Alabama in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Huntsville Alabama. There is no applicable special tax. You can use our Alabama Sales Tax Calculator to look up sales tax rates in Alabama by address zip code.

Real property tax on median home. As far as sales tax goes the zip code with the highest sales tax is 35801 and the zip code with the lowest sales tax is 35808. In Alabama the sales tax rate is 4 the sales tax rates in cities may differ to upto 5.

News World Report survey Contact Us 256 427-5000 Huntsville City Hall 308 Fountain Circle Huntsville Alabama 35801. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Huntsville AL. Your household income location filing status and number of personal exemptions.

The Sales tax rates may differ depending on the type of purchase. All persons or businesses that sell tangible personal property at retail must collect tax and make payments to the City. You can use our Alabama Sales Tax Calculator to look up sales tax rates in Alabama by address zip code.

For questions about Sales Tax you should contact the City Finance Department at 256 427-5080 or FinanceTaxhuntsvillealgov. The Huntsville Sales Tax is collected by the merchant on all qualifying sales made within Huntsville. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

General Sales Tax Rates for the Municipalities within. Within Huntsville there is 1 zip code with the most populous zip code being 62344. The sales tax rate does not vary based on.

The Alabama sales tax rate is currently.

Texas Sales Tax Calculator Reverse Sales Dremployee

Madison County Sales Tax Department Madison County Al

Sales Taxes In The United States Wikiwand

Alabama Vehicle Sales Tax Fees Calculator Find The Best Car Price

Ouch Alabama Has 4th Highest Combined Sales Tax Rate In The Country Yellowhammer News

Alabama Vehicle Sales Tax Fees Calculator Find The Best Car Price

What Is The Sales Tax Rate In Huntsville Al Dtaxc Cuitan Dokter

Alabama Income Tax Calculator Smartasset

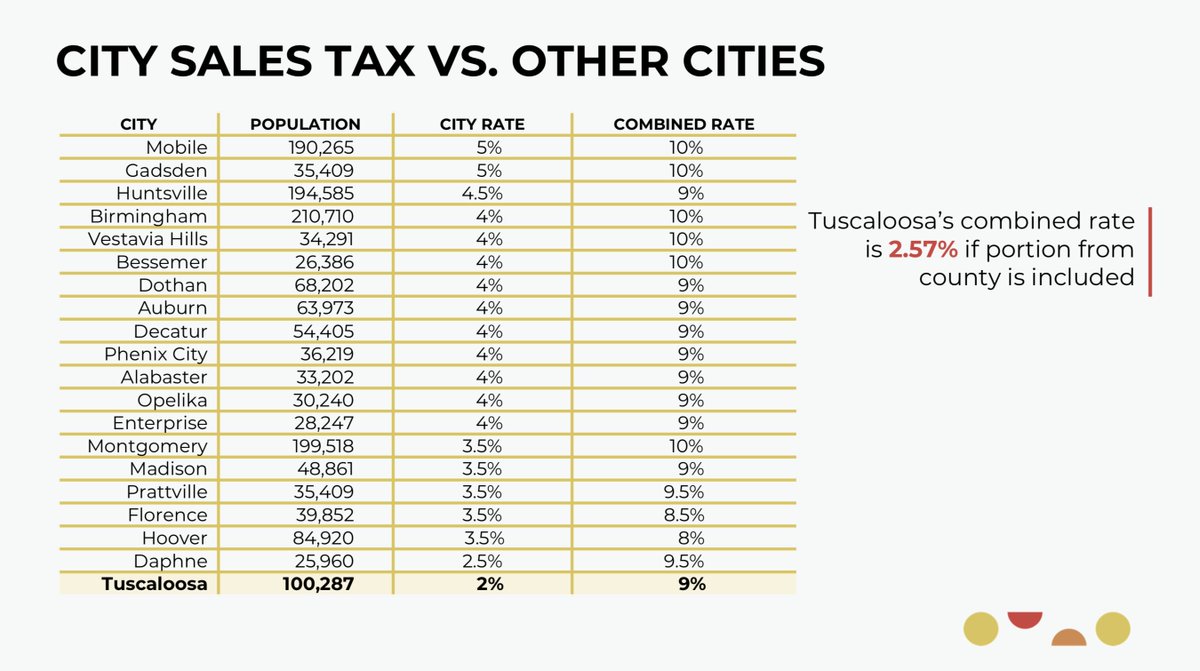

City Of Tuscaloosa On Twitter Tuscaloosa Continues To Do More With Less Having A Lower City Sales Tax Rate Than All Other Major Alabama Cities Towardtomorrow Https T Co Evsalsvway Twitter

Alabama Sales Tax Guide And Calculator 2022 Taxjar

Ouch Alabama Has 4th Highest Combined Sales Tax Rate In The Country Yellowhammer News