new orleans sales tax percentage

Yes sales tax is required on all food items. 150-874 of the City Code includes.

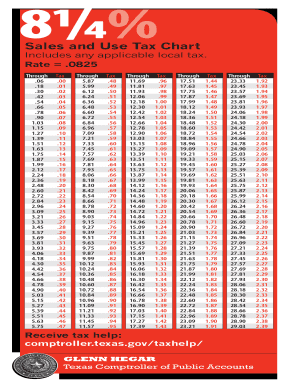

Sales Tax Chart Fill Out And Sign Printable Pdf Template Signnow

What is the sales tax in Louisiana 2021.

. Sales Tax provides a number of services for businesses and citizens in New Orleans. Orleans Parish Sales Tax Rate. There is no applicable city tax or special tax.

2020 rates included for use while preparing your income tax. Pay High Alcoholic Content Wholesale Dealer. The minimum combined 2022 sales tax rate for Orleans Parish Louisiana is.

The California sales tax rate is currently. Average Sales Tax With Local. Orleans Parish in Louisiana has a tax rate of 10 for 2022 this includes the Louisiana Sales Tax Rate of 4 and Local Sales Tax Rates in Orleans Parish totaling 6.

The average cumulative sales tax rate in New Orleans Louisiana is 943. Has impacted many state nexus laws and sales tax collection requirements. What is the sales tax rate in New Orleans Louisiana.

The minimum combined 2022 sales tax rate for Orleans California is. Select the Louisiana city from the list of cities. Lowest sales tax 445 Highest sales tax 1295 Louisiana Sales Tax.

The City of New Orleans tax rate is 5. New Rate Effective on all renewals on and after 1212019. Louisiana has recent rate changes Tue Oct 01 2019.

This is the total of state parish and city sales tax rates. The City of New Orleans tax rate is 5. The estimated 2022 sales tax rate for 70118 is 945.

See R-1002 Table of Sales Tax Rates for Exemptions for more information on the sales tax rate applicable to certain items. With local taxes the total sales tax rate is between 4450 and 11450. For example if you trade in your current vehicle and receive a 7000 credit on a new vehicle that costs 20000 you would only be required to pay sales tax on 13000 for the.

What is the sales tax in Louisiana 2021. Parish E-File can pay City of New Orleans and State of Louisiana sales taxes together SalesTaxOnline. 2022 List of Louisiana Local Sales Tax Rates.

Yes sales tax is required on all food items. This is the total of state and. As of July 1 2018 the state sales tax rate is 445.

French Quarter EDD Imposed A New SalesUse Tax Rate at 0245 effective Beginning October 1 2021 Ending June 30 2026 Form 8010. What is the sales tax rate for the 70118 ZIP Code. This is the total of state and parish sales tax rates.

Sales Tax Rate. Change Business Mailing Address. What is the sales tax rate in Orleans Parish.

The City of New Orleans sales tax rate on renting of any sleeping room will increase from 4 to 5. The state sales tax rate was 4 for periods prior to. How much is tax on food in New Orleans.

Sales Tax Holidays Politically Expedient But Poor Tax Policy The New Orleans sales tax rate is 945 What. If the salesuse tax paid at the time of purchase in another cityparishcounty was at a rate less than the use tax imposed by the City 5 or 45 credit is given only for the actual amount of. The California sales tax rate is currently.

This includes the rates on the state county city and special levels. Prior to July 1 2018 the state sales tax rate was 5 for the period of April 1 2016 through June 30 2018. What is the sales tax on food in New Orleans.

The City of New Orleans sales tax rate on renting of any sleeping room. All property tax bills for 2022 have been. The latest sales tax rate for New Orleans LA.

New Orleans has parts of it located within. The City of New Orleans sales tax rate on renting of any sleeping room will increase from 4 to 5. This rate includes any state county city and local sales taxes.

You can find more tax. The minimum combined 2022 sales tax rate for New Orleans Louisiana is. The 945 sales tax rate in New Orleans consists of 445 Louisiana state sales tax and 5 Orleans Parish sales tax.

The City of New Orleans today reminded residents the deadline for the 2022 property tax payments has been extended to March 15 2022. To review these changes visit our state-by-state guide. The 2018 United States Supreme Court decision in South Dakota v.

This is the total of state county and city sales tax rates. The definition of a hotel according to Sec.

Pennsylvania Sales Tax Guide For Businesses

Louisiana Vehicle Sales Tax Fees Find The Best Car Price

Louisiana S 9 52 Sales Tax 2nd Highest In U S Biz New Orleans

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Tax Policy States With The Highest And Lowest Taxes

Louisiana Sales Tax Small Business Guide Truic

Sales Tax On Grocery Items Taxjar

State And Local Sales Tax Rates 2013 Map Income Tax Property Tax

State And Local Sales Taxes In 2012 Tax Foundation

Which Cities And States Have The Highest Sales Tax Rates Taxjar

New Orleans Louisiana S Sales Tax Rate Is 9 45

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Georgia Sales Tax Guide For Businesses

Nevada Sales Tax Guide For Businesses

Illinois Sales Tax Guide For Businesses

Alabama Sales Tax Guide For Businesses

Analysis Shows Louisiana Has Highest Combined Sales Tax In U S Biz New Orleans

Internet Sales Taxes Tax Foundation

Sales Tax Holidays Politically Expedient But Poor Tax Policy