are campaign contributions tax deductible in 2019

To qualify the contribution must be. The bottom line is if you dont itemize and take the standard deduction you cant deduct charitable donations.

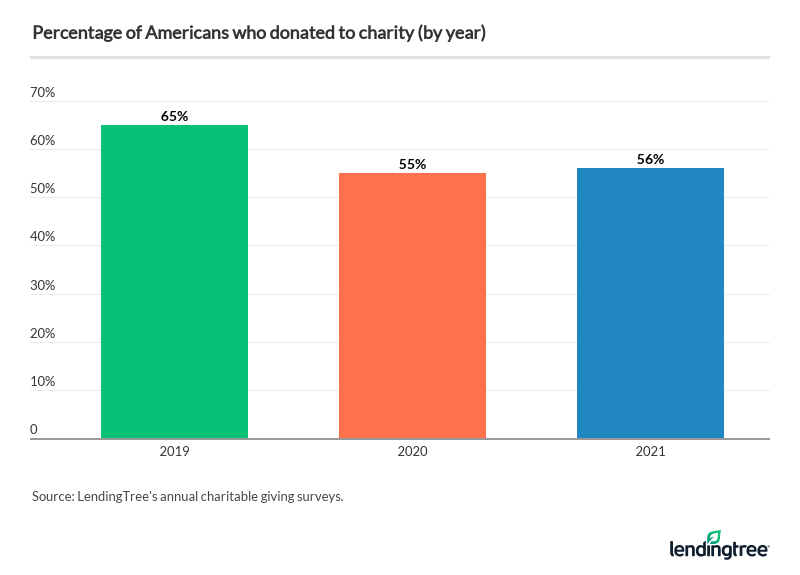

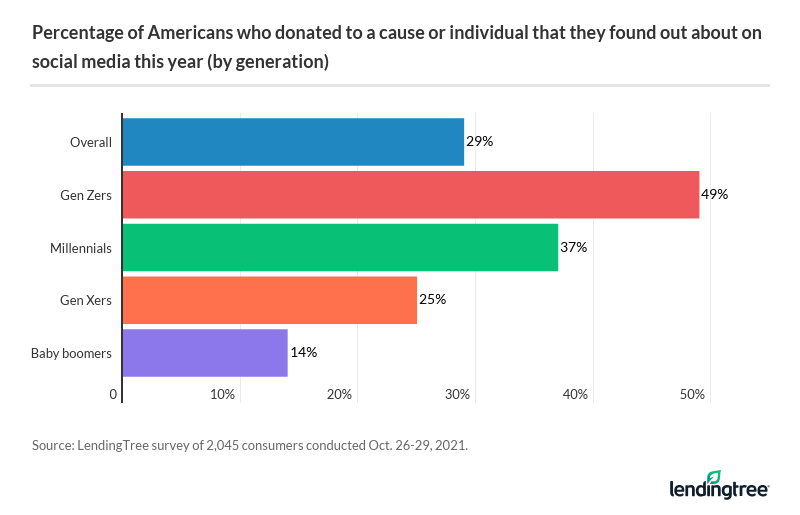

56 Of Americans Donated To Charity In 2021 Lendingtree

Otherwise the donations are not exempt from donors tax and not deductible as a political contribution on the part of the donor.

. Arkansas Ohio and Oregon offer a tax credit while Montana offers a tax deduction. But the federal tax code doesnt allow you to take a deduction for any political donations you make. The IRS is very clear that money contributed to a politician or political party cant be deducted from your taxes.

But when it comes to individual states thats not the whole story. According to the Internal Service Review IRS The IRS Publication 529 states. Are charitable contributions deductible in 2019.

You cannot deduct contributions made to a political candidate a campaign committee or a newsletter fund. You choose the charities and the amount. The answer is no political contributions are not tax deductible.

You cannot deduct expenses in support of any candidate running for any office even if you are spending money on your own campaign. After years of public service federal retirees may want to continue giving. If you made a contribution to a candidate or to a political party campaign or cause you may be wondering if your political contributions are tax deductible.

As circularized in Revenue Memorandum Circular 38-2018 and as reiterated in RMC 31-2019 campaign contributions are not included in the taxable income of the candidate to whom they were given the reason being that such contributions were given not for the personal expenditure or enrichment of the concerned candidate but for the purpose of utilizing such. It doesnt matter if it is an individual business or other organization making the donation the campaign contribution is not deductible. Are Political Contributions Tax Deductible.

Regardless of the form that a donation is given it is simply not deductible on your annual income tax returns. The IRS is very clear about whether you can deduct political campaign contributions from your Federal income taxes. The irs explicitly says that contributions to political campaigns and candidates are not tax.

Qualification and registration fees for primaries as well as a legal expenses related to a candidacy are not deductible either. A corporation may deduct qualified contributions of up to 25 percent of its taxable income. Contributions or gifts to Candidate Committees are not deductible as charitable contributions for federal income tax purposes but Ohio taxpayers may claim a state tax credit for contributions made to.

The Ohio Statehouse voted to remove this credit in 2019 then reinstated it at a later date. For 2019 the standard deduction is 12200 for single filers. Contributions or gifts to the peoples campaign are not tax deductible.

Are Political Contributions Tax Deductible Related Articles. Contribution amounts are often limited and the contributions are not tax-deductible. Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income.

On the part of the candidate to whom the contributions were given Revenue Regulations 7-2011 provides that as a general rule the campaign contributions are not included in their taxable income. For 2019 the standard deduction is 12200 for single filers and 24400 for joint filers. Learn how campaign contributions can be used when an election is over.

Are campaign contributions tax deductible in 2019. Many believe this rumor to be true but contrary to popular belief the answer is no. In most states you cant deduct political contributions but four states do allow a tax break for political campaign contributions or donations made to political candidates.

There will be a. Contributions that exceed that amount can carry over to the next tax year. The answer is a stone cold NO.

This stems from the presumption that campaign contributions are meant to be utilized by the candidate for his or her campaign and not for personal use and are thus not a proper inclusion to the candidates taxable income. The answer is no political contributions are not tax deductible. Simply make a contribution by the end of the year and get it back on your tax return.

You cannot deduct contributions made to a political candidate a campaign committee or a newsletter fund. All four states have rules and limitations around the tax break. The 2019-2020 contribution limit was capped at 2800.

During the 2019 campaign former Labor leader Bill Shorten further infuriated accountants by referring to the 3000 tax deduction limit for. As a result you may not itemize deductions this year even if youve consistently done so in the past. Heres how the tax credit works.

56 Of Americans Donated To Charity In 2021 Lendingtree

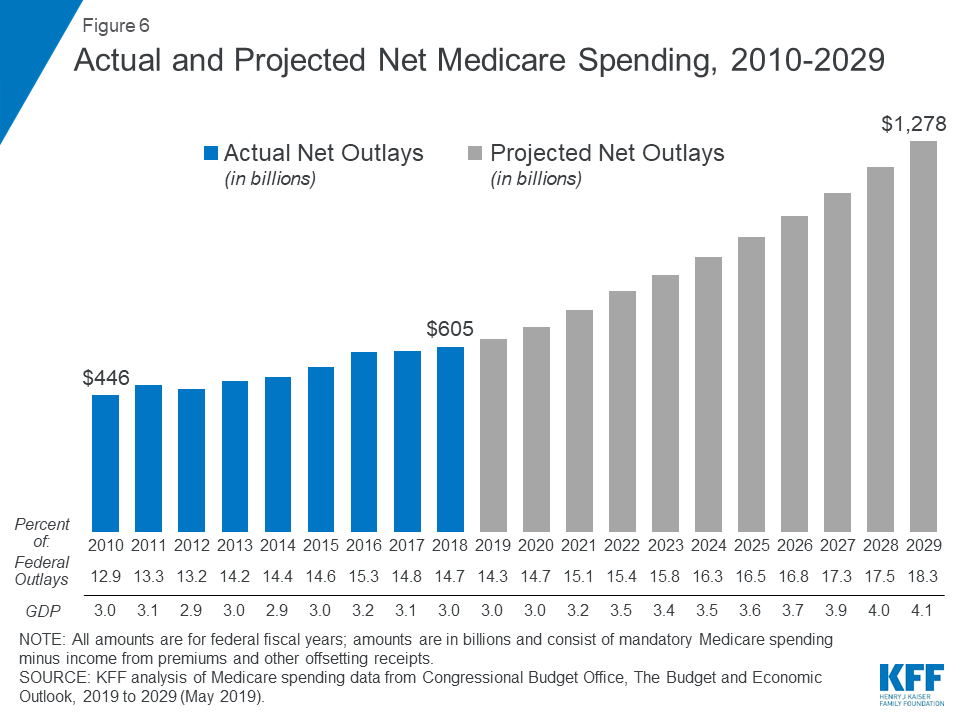

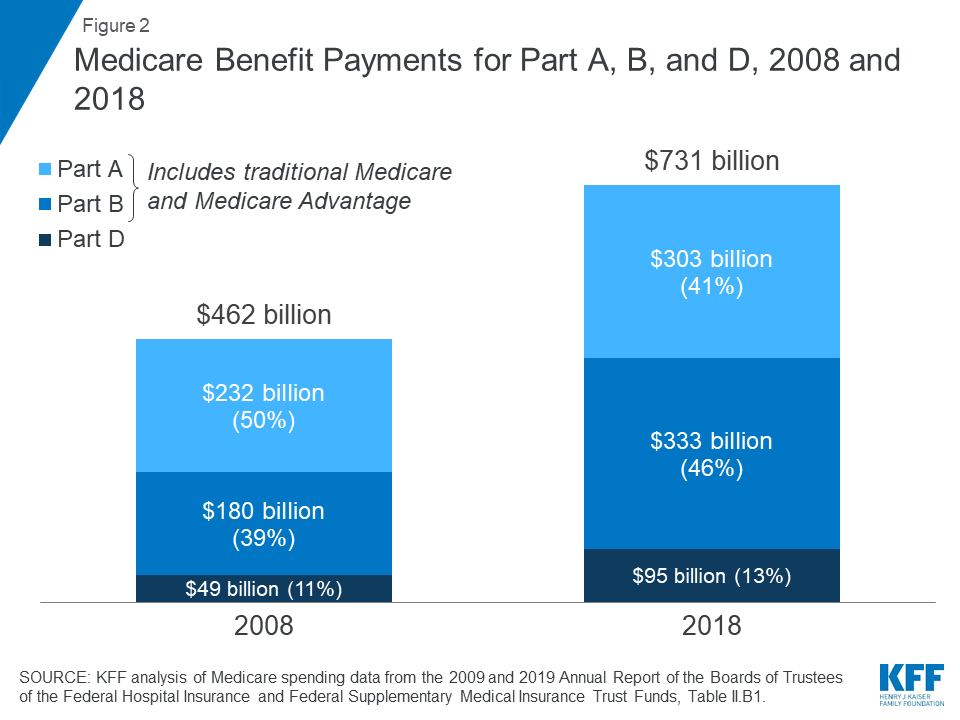

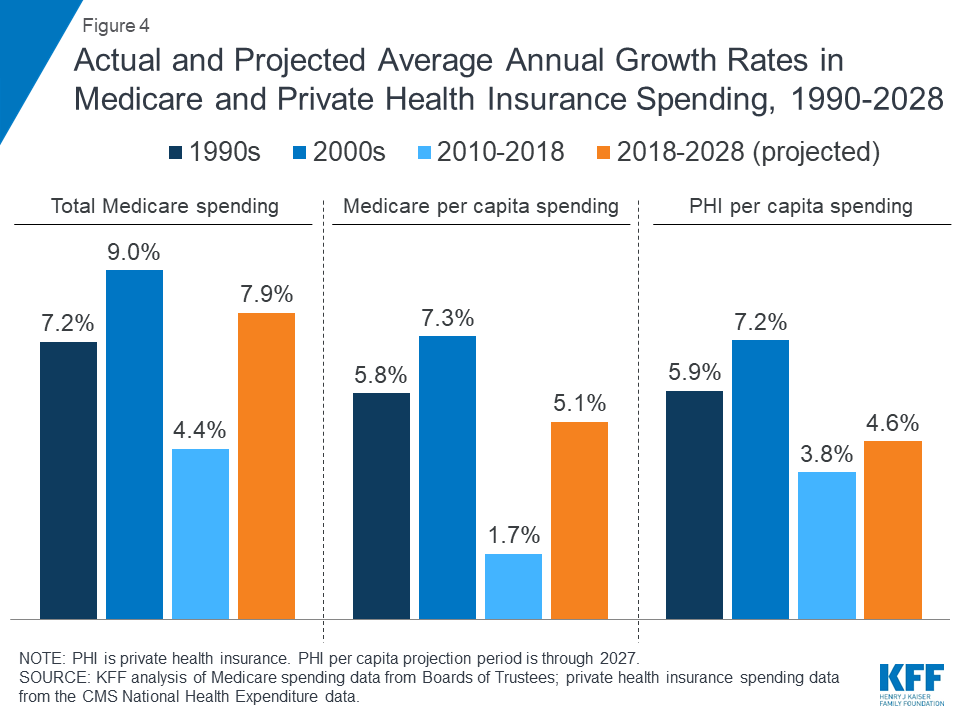

The Facts On Medicare Spending And Financing Kff

Taxability Of Campaign Contributions

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

Ending Foreign Influenced Corporate Spending In U S Elections Center For American Progress

Campaign Finance Info Pittsburghpa Gov

2020 Contribution Limits Increase For Utah Income Tax Credit Or Deduction

The Facts On Medicare Spending And Financing Kff

Are Political Donations Tax Deductible Credit Karma

Can Voluntary Carbon Markets Change The Game For Climate Change Raboresearch

Campaign Finance Info Pittsburghpa Gov

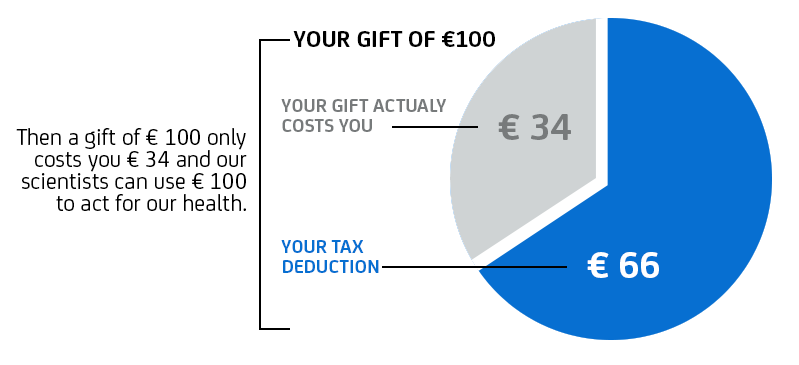

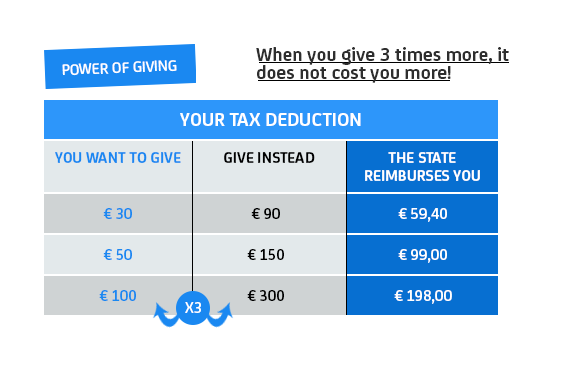

Tax Deductible Donations Institut Pasteur

Tax Deductible Donations Institut Pasteur

Ending Foreign Influenced Corporate Spending In U S Elections Center For American Progress

Can Voluntary Carbon Markets Change The Game For Climate Change Raboresearch

Can Voluntary Carbon Markets Change The Game For Climate Change Raboresearch

The Facts On Medicare Spending And Financing Kff

Can Voluntary Carbon Markets Change The Game For Climate Change Raboresearch